The smart Trick of Guided Wealth Management That Nobody is Talking About

The smart Trick of Guided Wealth Management That Nobody is Talking About

Blog Article

Not known Facts About Guided Wealth Management

Table of ContentsThe Only Guide to Guided Wealth ManagementGuided Wealth Management - An OverviewThe 10-Second Trick For Guided Wealth ManagementGet This Report on Guided Wealth ManagementGuided Wealth Management Can Be Fun For Anyone

The consultant will certainly set up a possession appropriation that fits both your risk tolerance and risk ability. Property allowance is merely a rubric to determine what portion of your total financial profile will be distributed across various possession classes.

The ordinary base income of a monetary advisor, according to Indeed since June 2024. Note this does not include an approximated $17,800 of annual commission. Any person can collaborate with an economic consultant at any age and at any type of stage of life. financial advisers brisbane. You don't need to have a high net well worth; you simply need to locate an advisor fit to your circumstance.

The smart Trick of Guided Wealth Management That Nobody is Discussing

If you can not afford such assistance, the Financial Preparation Association might have the ability to aid with done for free volunteer assistance. Financial advisors work for the client, not the company that utilizes them. They must be responsive, ready to clarify economic principles, and maintain the customer's finest passion in mind. If not, you ought to try to find a new advisor.

An expert can recommend feasible improvements to your strategy that might aid you attain your objectives a lot more properly. If you don't have the time or rate of interest to handle your funds, that's one more good reason to work with a monetary advisor. Those are some general reasons you could require an advisor's professional assistance.

A good financial consultant should not simply sell their solutions, yet offer you with the devices and resources to end up being monetarily wise and independent, so you can make educated decisions on your own. You desire a consultant that stays on top of the economic scope and updates in any kind of location and who can answer your financial concerns about a myriad of topics.

Getting My Guided Wealth Management To Work

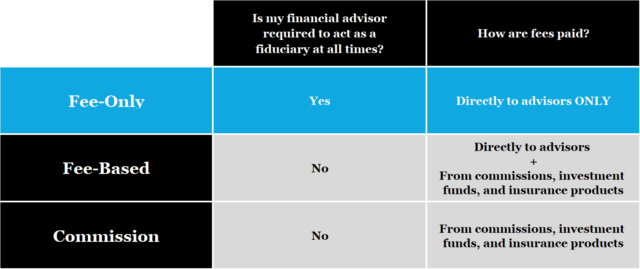

Others, such as qualified financial planners(CFPs), currently complied with this standard. Even under the DOL regulation, the fiduciary requirement would not have actually used to non-retirement guidance. Under the suitability criterion, financial experts generally service compensation for the items they sell to customers. This suggests the customer may never ever obtain an expense from the monetary consultant.

Some experts might offer reduced rates to aid clients that are just obtaining begun with monetary preparation and can not manage a high regular monthly price. Typically, a monetary consultant will certainly offer a cost-free, initial examination.

A fee-based consultant may earn a fee for establishing a monetary plan for you, while also making a commission for marketing you a certain insurance product or investment. A fee-only monetary expert makes no payments.

Some Known Incorrect Statements About Guided Wealth Management

Robo-advisors do not require you to have much money to get going, and they set you back less than human economic advisors. Instances include Improvement and Wealthfront. These solutions can save you time and potentially cash as well. A robo-advisor can not speak with you regarding the finest method to get out of debt or fund your child's education and learning.

A consultant can help you determine your financial savings, how to build for retirement, aid with estate planning, and others. If nonetheless you only require to discuss profile allotments, they can do that too (generally for a charge). Financial advisors can be paid in a number of means. Some will be commission-based and will make a percentage of the products they guide you right into.

Guided Wealth Management Things To Know Before You Get This

Marriage, separation, remarriage or just relocating with a new companion are all milestones that can call for mindful planning. Along with the frequently hard emotional ups and downs of separation, both companions will have to deal with important monetary considerations. Will you have sufficient earnings to sustain your way of life? Exactly how will your financial investments and other possessions be split? You might extremely well require to transform your financial approach to keep your goals on course, Lawrence says.

An unexpected influx of cash or possessions elevates prompt questions regarding what to do with it. "An economic advisor can help you think with the means you might place that money to pursue your individual and economic goals," Lawrence says. You'll wish to think of just how much could most likely to paying for existing financial debt and just how much you may think about spending to go after a more safe and secure future.

Report this page